C1N.TV Network News

This is C1N network television news, newspaper and columns from around the world by our reporters

Occupy Denver to protest Georgetown evistion

Oct 25th

She has fought them in court, but is now facing eviction and has requested that Occupy Denver stand with her at her home in hope of persuading the police to do the right thing and allow her some more time to continue her legal efforts. She has asked the bank for 30 days during which time she can find another living situation, but the bank has denied her requests. Members of Occupy Denver are answering her call for help and are occupying her home with her as of Wednesday night. To help us succeed in keeping Sahara in her home of 24 years, we ask that you get involved in this home occupation taking place at 170 Peaceful Valley Lane, Idaho Springs, CO, 80452. To get there, drive west on I70 and take exit 240. Go left at the stop sign on highway 103. After 9.5 miles, there will be two mailboxes on the right marking Peaceful Valley Lane, marked also by a green sign with this street name. Drive 300 yards up this dirt road, then take the right hand turn at the fork in the road, and her house is on the right side of a circular driveway.

for info contact Chris at 720-291-4267 or email outreach@occupydenver.org

Big Oil claims the right to bribe under the First Amendment. Taking the Fifth is more appropriate.

Oct 23rd

In a new lawsuit against the Securities and Exchange Commission (SEC), big energy extractors are pushing for carte blanche in their interactions with foreign governments, making it harder to track whether their deals are padding the coffers of dictators, warlords, or crony capitalists. The United States Chamber of Commerce, American Petroleum Institute, the Independent Petroleum Association of America, and the National Foreign Trade Council filed a lawsuit on October 10, 2012 against a new SEC rule, which requires U.S. oil, mining and gas companies to formally disclose payments made to foreign governments as part of their annual SEC reporting.

This lawsuit is not the only effort underway to make it easier for American corporations working overseas to bribe corrupt government officials. The U.S. Chamber of Commerce is also pushing for a radical rollback of a 35 year old anti-bribery statute that has been tripping up U.S. companies abroad.

New SEC Rule Forces Disclosure of Financial Transactions With Foreign Governments

The challenged SEC provision, which aims to bring transparency to U.S. corporate payments to foreign governments abroad in an effort to combat bribery and corruption, was required by Congress in a last minute addition to the 2010 Dodd-Frank Wall Street reform bill. Some parts of Dodd-Frank have gone into effect while others are still under assault by industry in the lengthy rule-making processes. Senators Dick Lugar (R-Indiana) and Ben Cardin (D-Maryland) authored the provision, which simply requires U.S. corporations to report in their annual SEC filing any payments made to foreign governments.

This legislation is a crucial step in increasing transparency and accountability in countries with a history of government corruption. In many countries, there are often huge discrepancies between what companies might say that they paid the government and what the government said it received. Formal disclosure can serve as a critical tool for activists and citizens fighting corruption and poverty, which is why the measure was backed by groups like Oxfam International and Bono’s ONE campaign.

“The Cardin-Lugar Amendment puts transparency — the key to citizens’ ability to hold their government to account — ahead of corruption. To do otherwise is a losing proposition for the United States and company shareholders,” Lugar said in a statement this week. The SEC worked on the rule for two years with abundant business input.

Lawsuit Alleges Rule too Costly, Violates Corporate Rights

The groups which filed the lawsuit allege that the SEC failed to take into account the rule’s costs and benefits and that it “grossly misinterpreted its statutory mandate” in crafting the rule and has violated corporate “First Amendment” rights.

For supporters, it is difficult to see what is so costly about inserting a few paragraphs into an annual SEC filing. “We are greatly disappointed that the oil industry is trying to use the courts to bully the SEC and push for secrecy in their payments to governments,” said Ian Gary of Oxfam. “We call on companies, such as BP, Exxon, Chevron and Shell, who are hiding behind industry associations to do their dirty work while espousing transparency rhetoric, to disassociate themselves from the lawsuit.”

The attorney heading the challenge to the Dodd-Frank anti-bribery rule is Eugene Scalia, son of Supreme Court Justice Antonin Scalia. Of the six challenges that SEC regulations have faced and lost in federal court of appeals in Washington, DC since the mid 2000s, Eugene Scalia was behind four. He won a case on behalf of the U.S. Chamber of Commerce last year on the Dodd-Frank “proxy access rule,” which would have allowed shareholders to play a role in nominating company directors. Scalia also helped win a case in September against the SEC on a rule which would have imposed trading limits on speculators.

U.S. Chamber of Commerce Tries to Gut Foreign Corrupt Practices Act

Efforts to keep bribery under a veil of secrecy go beyond attacks against the SEC transparency rule. The U.S. Chamber of Commerce has also been waging a war against the 1977 Foreign Corrupt Practices Act, which was adopted after a rash of bribery scandals of foreign officials was revealed, involving more than 400 U.S. corporations. The law, introduced by Senator William Proxmire (D-Wisconsin), bans companies from bribing foreign officials in order to secure land and retain business deals, and requires public companies to file financial statements and maintain internal controls. The Department of Justice (DOJ) and SEC are responsible for its enforcement and have been stepping up the pace in recent years, dedicating new staff and resources to a crackdown.

Now, the Chamber is actively pushing five amendments to the 1977 law, which would significantly weaken its enforcement mechanisms.

The value of the law was recently highlighted when The New York Times broke the story this spring that Walmex (Wal-Mart in Mexico), executives allegedly covered up millions of dollars in bribes to Mexican officials in an effort to fuel the company’s expansion in the country. Wal-Mart says it spent some $51 million on an internal investigation looking into whether the subsidiary violated the anti-bribery law and the U.S. Justice Department is also investigating.

According to the Chamber’s tax filings, 14 of the group’s 55 board members between 2007 and 2010 “were affiliated with companies that were reportedly under investigation for violations or had settled allegations that they violated the Foreign Corrupt Practices Act.” Chamber member Pfizer recently paid $60 million to the SEC and DOJ to settle claims that its subsidiaries bribed foreign doctors and pubic officials to gain market access for its products in Eastern Europe.

Major American firms frequently embrace transparency as an alternative to mandatory binding regulation. Now transparency is also taking a beating as U.S. firms fight for the right to bribe foreign governments and hide their activities from American shareholders and the citizens of the nations where they do business.

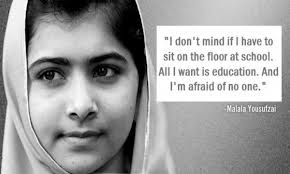

Malala Lives !!

Oct 19th

z

The Taliban have threatened to target Malala again and she was given tight security for her journey to the UK on Monday.

She and two other schoolgirls were attacked as they returned home from school in Mingora in the Swat Valley almost a week earlier.

The gunman who boarded the van in which she was travelling asked for her by name before firing three shots at her.

Malala is widely known as a campaigner for girls’ education in Pakistan. In early 2009 she wrote an anonymous diary for BBC Urdu about life under the Taliban, who had banned all girls in her area from attending school.